Assess and compare and Switch to Medicare Advantage Plans: Cut Hundreds on Insurance and Start Today

Getting familiar with Medicare Advantage Plans

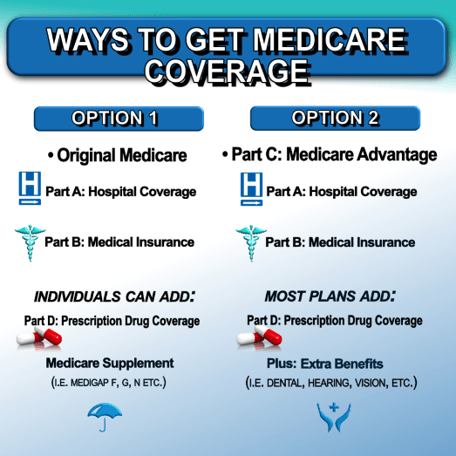

Medicare Advantage Plans exist as made available by non-government Insurance providers that contract with Medicare to deliver Part A with Part B benefits in one combined model. Unlike traditional Medicare, Medicare Advantage Plans frequently feature supplemental services such as drug coverage, oral health care, eye care services, and also wellness programs. These Medicare Advantage Plans function within specific geographic boundaries, making geography a important factor during evaluation.

Ways Medicare Advantage Plans Vary From Traditional Medicare

Traditional Medicare offers open provider availability, while Medicare Advantage Plans often use structured networks like HMOs alternatively PPOs. Medicare Advantage Plans often involve provider referrals with in-network doctors, but they often balance those limitations with structured expenses. For many individuals, Medicare Advantage Plans provide a middle ground between budget awareness as well as added benefits that Original Medicare independently does not usually provide.

Which individuals Should Look into Medicare Advantage Plans

Medicare Advantage Plans appeal to beneficiaries looking for managed healthcare delivery and potential expense reductions under one policy. Seniors handling long-term medical issues often choose Medicare Advantage Plans because connected care approaches reduce complexity in treatment. Medicare Advantage Plans can additionally appeal to people who want packaged benefits without maintaining multiple secondary plans.

Eligibility Criteria for Medicare Advantage Plans

To qualify for Medicare Advantage Plans, enrollment in Medicare Part A together with Part B required. Medicare Advantage Plans are accessible for most beneficiaries aged 65 and/or older, as well as under-sixty-five individuals with qualifying medical conditions. Participation in Medicare Advantage Plans depends on residence within a plan’s coverage region along with enrollment timing that matches authorized sign-up windows.

Best times to Sign up for Medicare Advantage Plans

Timing holds a critical role when joining Medicare Advantage Plans. The First-time Enrollment Period centers around your Medicare eligibility date also permits first-time choice of Medicare Advantage Plans. Missing this timeframe does not necessarily end eligibility, but it often limit future options for Medicare Advantage Plans later in the calendar cycle.

Yearly along with Qualifying Enrollment Periods

Each fall, the Annual Enrollment Period allows beneficiaries to switch, drop, alternatively add Medicare Advantage Plans. Special Enrollment Periods open when qualifying events happen, such as moving with loss of coverage, enabling changes to Medicare Advantage Plans beyond the normal schedule. Understanding these windows helps ensure Medicare Advantage Plans remain available when circumstances change.

Ways to Evaluate Medicare Advantage Plans Successfully

Reviewing Medicare Advantage Plans requires focus to beyond monthly costs alone. Medicare Advantage Plans change by network structures, out-of-pocket maximums, prescription formularies, with coverage PolicyNational guidelines. A thorough review of Medicare Advantage Plans helps matching medical requirements with coverage designs.

Costs, Coverage, along with Network Networks

Monthly costs, copays, and yearly caps all influence the value of Medicare Advantage Plans. Some Medicare Advantage Plans include minimal premiums but higher cost-sharing, while others prioritize predictable spending. Doctor access also differs, so making it important to verify that regular providers accept the Medicare Advantage Plans under consideration.

Drug Benefits not to mention Additional Benefits

A large number of Medicare Advantage Plans offer Part D prescription benefits, easing medication management. Beyond medications, Medicare Advantage Plans may include fitness programs, transportation services, and/or OTC benefits. Assessing these elements helps ensure Medicare Advantage Plans match with daily medical priorities.

Signing up for Medicare Advantage Plans

Registration in Medicare Advantage Plans can happen online, by phone, even through authorized Insurance professionals. Medicare Advantage Plans require precise individual information & confirmation of eligibility before activation. Finalizing enrollment properly helps avoid delays along with unexpected benefit gaps within Medicare Advantage Plans.

The Value of Authorized Insurance Agents

Licensed Insurance Agents assist explain coverage specifics plus describe distinctions among Medicare Advantage Plans. Consulting an experienced professional can clarify provider network rules, coverage limits, & expenses linked to Medicare Advantage Plans. Expert assistance often streamlines the selection process during enrollment.

Typical Mistakes to Avoid With Medicare Advantage Plans

Ignoring doctor networks remains among the common mistakes when choosing Medicare Advantage Plans. A separate problem relates to focusing only on premiums without reviewing total expenses across Medicare Advantage Plans. Examining coverage documents carefully prevents misunderstandings after sign-up.

Reevaluating Medicare Advantage Plans Each Coverage Year

Healthcare priorities shift, in addition to Medicare Advantage Plans update each year as part of that process. Evaluating Medicare Advantage Plans during open enrollment allows adjustments when coverage, costs, as well as providers change. Ongoing review helps keep Medicare Advantage Plans aligned with current medical needs.

Reasons Medicare Advantage Plans Continue to Increase

Enrollment trends demonstrate increasing engagement in Medicare Advantage Plans across the country. Broader benefits, defined out-of-pocket limits, with managed healthcare delivery help explain the appeal of Medicare Advantage Plans. As offerings increase, well-researched review becomes even more important.

Long-Term Benefits of Medicare Advantage Plans

For a large number of individuals, Medicare Advantage Plans provide consistency through integrated coverage with organized care. Medicare Advantage Plans can minimize administrative burden while supporting preventive services. Choosing suitable Medicare Advantage Plans creates assurance throughout retirement stages.

Review & Enroll in Medicare Advantage Plans Today

Taking the next step with Medicare Advantage Plans begins by reviewing local choices along with checking qualification. If you are currently entering Medicare and revisiting existing coverage, Medicare Advantage Plans present flexible coverage options designed for different healthcare priorities. Explore Medicare Advantage Plans now to find a plan that supports both your medical needs also your budget.